Your Mr diy share ipo images are ready in this website. Mr diy share ipo are a topic that is being searched for and liked by netizens now. You can Find and Download the Mr diy share ipo files here. Download all free photos.

If you’re searching for mr diy share ipo pictures information related to the mr diy share ipo topic, you have come to the ideal site. Our site always gives you hints for refferencing the maximum quality video and image content, please kindly search and find more enlightening video content and graphics that match your interests.

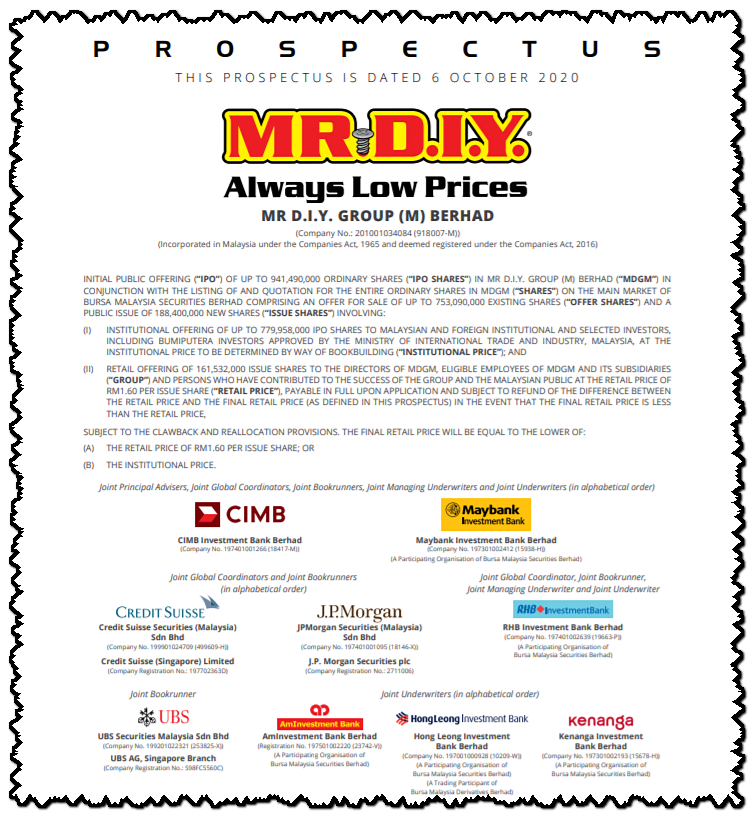

Mr Diy Share Ipo. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Edited excerpts of the interview with Martin.

Begging The Question Circular Argument Petitio Principii Funny Puns Jokes Dark Humour Memes Psychology Memes From pinterest.com

Begging The Question Circular Argument Petitio Principii Funny Puns Jokes Dark Humour Memes Psychology Memes From pinterest.com

Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Investor interest in CTOS as well as MR DIY continues to be keen.

HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end.

Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Edited excerpts of the interview with Martin. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO.

Source: sec.gov

Source: sec.gov

Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449.

Source: pinterest.com

Source: pinterest.com

Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. Investor interest in CTOS as well as MR DIY continues to be keen. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end.

Source: no.pinterest.com

Source: no.pinterest.com

Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Edited excerpts of the interview with Martin.

Source: pinterest.com

Source: pinterest.com

Edited excerpts of the interview with Martin. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Investor interest in CTOS as well as MR DIY continues to be keen. Edited excerpts of the interview with Martin. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449.

Source: theedgemarkets.com

Source: theedgemarkets.com

Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. Investor interest in CTOS as well as MR DIY continues to be keen. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end.

Source: financemalaysia.blogspot.com

Source: financemalaysia.blogspot.com

Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion.

Source: investopedia.com

Source: investopedia.com

The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449.

Source: seekingalpha.com

Source: seekingalpha.com

Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Edited excerpts of the interview with Martin. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO.

Source: pinterest.com

Source: pinterest.com

Edited excerpts of the interview with Martin. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Investor interest in CTOS as well as MR DIY continues to be keen. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO.

Source: pinterest.com

Source: pinterest.com

Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Edited excerpts of the interview with Martin. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end.

Edited excerpts of the interview with Martin. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Edited excerpts of the interview with Martin. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Investor interest in CTOS as well as MR DIY continues to be keen.

Source: pinterest.com

Source: pinterest.com

Investor interest in CTOS as well as MR DIY continues to be keen. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Investor interest in CTOS as well as MR DIY continues to be keen. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449.

Source: pinterest.com

Source: pinterest.com

The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Edited excerpts of the interview with Martin. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end.

Source: pinterest.com

Source: pinterest.com

Investor interest in CTOS as well as MR DIY continues to be keen. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end.

Source: pinterest.com

Source: pinterest.com

Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Investor interest in CTOS as well as MR DIY continues to be keen. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion.

Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. Investor interest in CTOS as well as MR DIY continues to be keen. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion.

Source: pinterest.com

Source: pinterest.com

Investor interest in CTOS as well as MR DIY continues to be keen. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Edited excerpts of the interview with Martin. Investor interest in CTOS as well as MR DIY continues to be keen. HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end.

Source: pinterest.com

Source: pinterest.com

HSBC will acquire the mutual fund business of LT Finance Holdings in a deal worth 425 million which values the latter at 4 of its assets under management AUM of Rs 78273 crore as of September end. Shares in CTOS have risen 65 from its IPO price giving it a current market cap of RM4 billion. Star Health and Allied Insurance Company has fixed a price band of Rs 870-900 a share for its Rs 7249-crore IPO. The public issue of Star Health and Allied Insurance Company continued to see muted response from investors as the offer received bids for 353 crore equity shares against an issue size of 449. Shares in MR DIY are trading at more than double their price at IPO giving the company a market cap of nearly RM 22 billion.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title mr diy share ipo by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.